As someone with an overwhelming amount of student loans, this essay from N+1 Magazine awfully hit close to home:

Since 1978, the price of tuition at US colleges has **increased over 900 percent, 650 points above inflation.** To put that number in perspective, housing prices, the bubble that nearly burst the US economy, then the global one, increased only fifty points above the Consumer Price Index during those years. But while college applicants’ faith in the value of higher education has only increased, employers’ has declined.

According to Richard Rothstein at The Economic Policy Institute, wages for college-educated workers outside of the inflated finance industry have stagnated or diminished. Unemployment has hit recent graduates especially hard, nearly doubling in the post-2007 recession. The result is that the most indebted generation in history is without the dependable jobs it needs to escape debt.

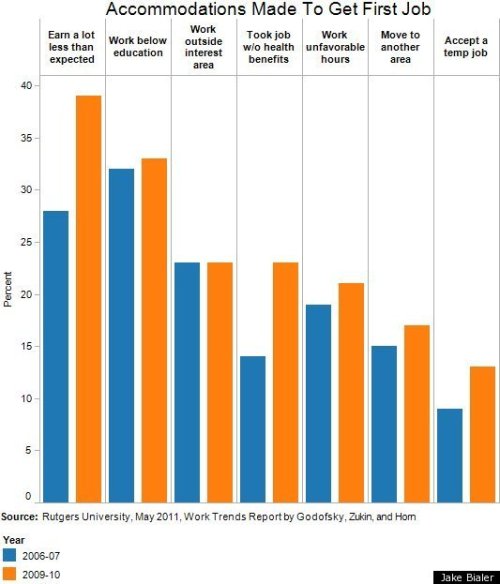

This does not inspire great confidence. Oh, and one of the ilovecharts guys made this handy chart to accompany his Forbes.com op-ed; his essay is about how mine is the Lost Generation because old people forgot to leave us a market to graduate into:

Thanks old people. We all borrowed money to haul ourselves up by our bootstraps like you said we could, and we assumed that we’d join a workforce that could pay us. This assumption did not accurately reflect reality.

But either way, lenders were happy to put us on the hook for tens or hundreds of thousands of dollars, because they knew that if we didn’t pay, the government would. From the N+1 essay again:

With the secondary market in such good shape, primary lenders have been eager to help students with out-of-control costs. In addition to the knowledge that they can move these loans off their balance sheets quickly, they have had another reason not to worry: federal guarantees. Under the just-ended Federal Family Education Loan Program (FFELP), the US Treasury backed private loans to college students. This meant that even if the secondary market collapsed and there were an anomalous wave of defaults, the federal government had already built a lender bailout into the law.

In summary, we borrowed a lot, we can’t pay it because the economy sucks, so the government will pay it, and we’ll just pay the government. And also at some point we’ll ruin our credit scores. Yay.

Even then, your generation is going to die first, and mine will be stuck with the onerous task of paying off the national debt. Actually, realistically, it’ll probably be my kids’ generation. But I’d like you to know that I kind of resent your failure to leave my generation with an opportunity to retire.